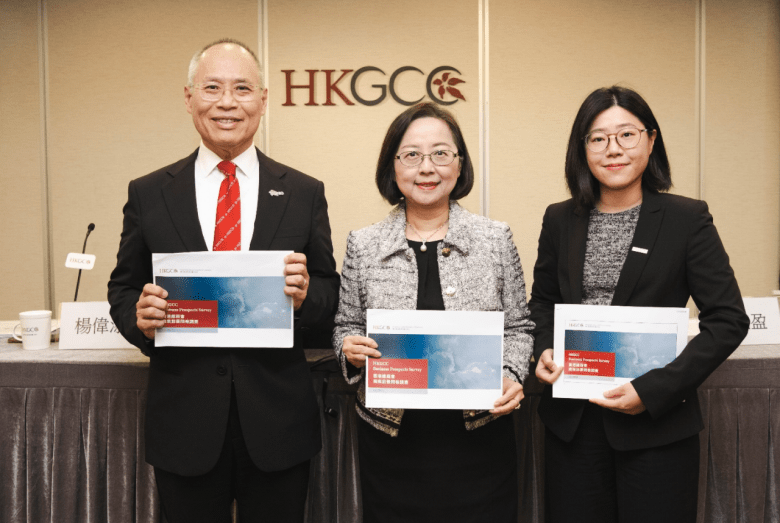

Businesses Remain Cautiously Hopeful Amid Global Economic Challenges

Businesses in Hong Kong are displaying cautious optimism about their prospects for the upcoming year, according to the Hong Kong General Chamber of Commerce’s (HKGCC) most recent Business Prospects Survey, conducted between 12-26 November. Respondents pointed to the slowing global economy, high costs, and geopolitical uncertainties as their primary challenges.

In the first ten months of 2024, over 60% of businesses reported that their turnover either increased (29.2%) or remained stable (31%) compared to the previous year. Looking ahead, 31.1% of businesses expect growth, while 45.2% anticipate no change. Regarding the broader economic outlook for Hong Kong in the next 12 months, 18.3% expressed optimism, 25.1% expected no change, and 44.3% were pessimistic.

HKGCC Chairman Agnes Chan commented, ““Our members indicated they remained positive about the growth of their business and investment in the Mainland, ASEAN, and the Middle East,”.

On the hiring front, 26% of respondents plan to expand their workforce, 49.8% intend to maintain current staff levels, and 17.4% foresee a reduction in headcount. Furthermore, 39.7% of companies intend to raise base salaries, while only 1.8% plan salary cuts. Recruitment difficulties have eased, with only 10% of respondents reporting significant hiring challenges.

Regarding investment plans, businesses are expected to be more cautious, with 61.2% of respondents indicating that their capital investment will remain unchanged over the next year, a slight increase from 57.5% in the previous year. However, 14.2% of companies plan to increase their capital investment, while 11.4% expect to reduce it.

Investment sentiment in the Greater Bay Area (GBA), excluding Hong Kong, was notably more positive. Among those already invested in the region, 34% intend to increase their investments over the next 12 months, compared to just 5.4% who plan to reduce their investment. Similarly, 27.5% of businesses in the Mainland are looking to increase investment, while 48.9% will maintain their current capital allocation.

Regionally, businesses are optimistic about ASEAN and Middle Eastern markets, with 38.6% planning to invest more in ASEAN and 25.9% in the Middle East. Over half (53.9%) of respondents indicated they are focusing on business diversification, primarily by expanding into new markets (63.6%) and broadening their product or service offerings (61%). The main barriers to diversification were limited resources (53.9%) and high costs (51.1%), followed by skills gaps among employees.

A new question in this year’s survey explored the use of artificial intelligence (AI) in operations. Almost half (49.3%) of respondents are using AI on a limited basis, and 7.8% are utilizing it extensively. Additionally, 25.6% plan to adopt AI in the future, while 17.4% have no intentions to use it at all.

“The respondents ranked a lack of skills among staff and the lack of technical talent as the main obstacles to using AI, so this is something that needs to be tackled to help companies, or they risk being left behind their competitors,” said Chan.

HKGCC also shared its 2025 economic forecast, projecting real GDP growth of 2.3% and headline inflation of 2.0%. While Hong Kong continues its post-pandemic recovery, it faces both internal and external economic challenges. However, the commencement of major infrastructure projects, such as the three-runway system and Kai Tak Sports Park, is expected to support long-term growth and strengthen Hong Kong’s competitiveness.

| HKGCC Economic Forecasts | 2024 | 2025 |

| Real GDP Growth | 2.4% | 2.3% |

| Headline Inflation | 2.1% | 2.0% |

| Unemployment Rate (year-end) | 3.1% | 3.3% |

| Retail Sales Growth | -6.9% | 2.0% |

| Merchandise Exports Growth | 8.9% | 2.0% |

Survey Overview

The annual Business Prospects Survey was conducted from November 12 to 26, 2024, and gathered 219 valid responses. The largest share of respondents came from professional and business services (28.8%), followed by trading companies (19.2%) and financial services (10%).

You can download the survey slides here.

SOURCE:

https://www.chamber.org.hk/en/media/press-releases_detail.aspx?ID=3796

Media inquiries: Please contact Mr. Jonathan Man at 2823-1229 / jonathan@chamber.org.hk