HKGCC Budget Recommendations Aim to Boost Economic Growth and Tackle Deficit

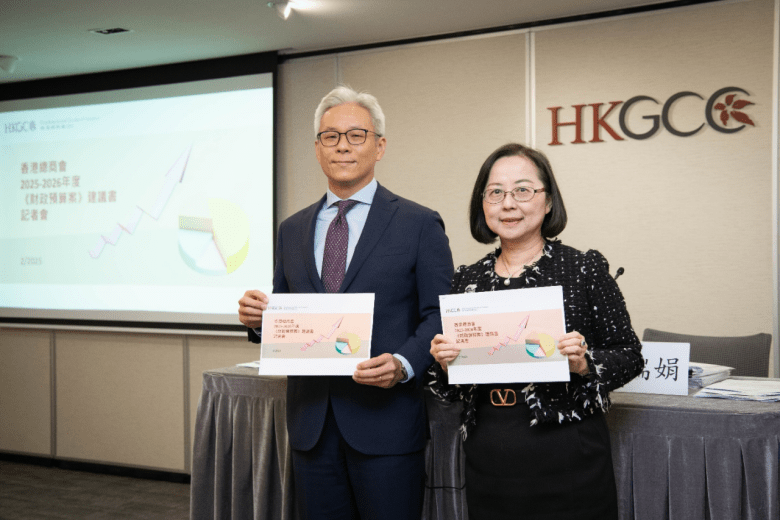

The Hong Kong General Chamber of Commerce (HKGCC) has outlined a series of proposals aimed at addressing the city’s budget deficit and revitalizing the economy in its latest submission to the Financial Secretary ahead of the upcoming Budget Address.

The Chamber’s recommendations focus on three main pillars: Supporting People and Businesses, Enhancing Hong Kong’s Competitiveness, and Preparing for an Ageing Population.

To tackle immediate fiscal pressures, HKGCC Chairman Agnes Chan proposed introducing a digital services tax on non-resident providers. “Drawing on international practices, we suggest a tax rate between 3% and 5% on a narrow range of digital activities. This would level the playing field for local suppliers, strengthen economic resilience, and reinforce Hong Kong’s reputation as a dynamic, forward-looking financial hub,” Chan explained.

Highlighting the rising cost of the Government’s Public Transport Fare Concession Scheme for the Elderly—which reached HK$4.275 billion in 2023-24—HKGCC suggests placing an annual cap of 750 trips for individuals aged 60 to 64, while maintaining current benefits for those aged 65 and over.

The Chamber also calls for a review of the civil service structure and salaries to streamline operations, eliminate redundancy, and ensure alignment with private sector benchmarks.

Given the lingering economic challenges posed by global uncertainties and structural changes, HKGCC further recommends that the Government offer long-term fixed-rate mortgage loans. Such measures would help SMEs manage interest rate risks and support their resilience during a period of economic transition.

Wayne Lau, Chairman of the HKGCC Taxation Committee, elaborated that the proposal includes extending long-term fixed-rate mortgages to businesses for the purchase of offices or operational premises. Payments under these schemes would align with current rent levels, offering businesses greater financial stability as they navigate restructuring.

Enhancing Hong Kong’s global competitiveness is another key priority. HKGCC advocates for strategies to attract and retain talent and businesses, promote public-private partnerships, further expand the bond market, advance RMB internationalization, and offer tax incentives to foster emerging industries like the low-altitude economy.

Highlights of the HKGCC Submission Include:

- Support for SMEs and the Public

- Increasing Revenue

- Containing Expenditure

- Financial Markets and Products

- RMB Internationalization

- Taxing Non-HK Resident Digital Service Suppliers

- Human Capital

- Headquarters Economy

- Greater Bay Area

- Innovation and Technology

- Real Estate

- Primary Healthcare

- Retirement Savings

A summary of the key proposals is available here, and the full submission can be downloaded for further details.

SOURCE:

Media inquiries: Please contact Ally Wan at 2823 1266 / ally@chamber.org.hk